Innovation Is for Finishers

Entrepreneurs are helping universities deliver on the promise that taxpayer-funded research will drive economic growth, and lately, universities are doing much more to help them succeed.

Entrepreneurs are helping universities deliver on the promise that taxpayer-funded research will drive economic growth, and lately, universities are doing much more to help them succeed.

Pacemakers, insulin, Breathalyzer tests, computers and MRI machines are university developments. All of these technologies were so obviously important that they were adopted long before universities began making an effort to get laboratory inventions out the door. But many more sat on the shelves.

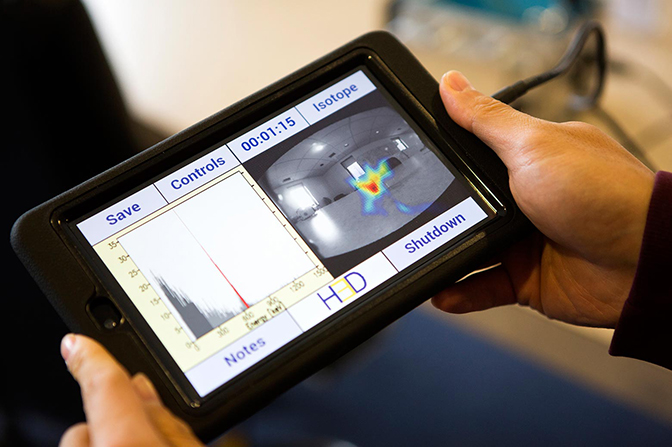

One of these was a plan for a radiation camera that was capable of overlaying an image of the room with a map of radiation sources. Initially proposed in the mid-1990s by Zhong He, a professor of nuclear engineering and radiological sciences at U-M, it might have been ready to deploy in the areas around Fukushima following the disaster in March 2011.

But the companies that were theoretically capable of rapidly developing such a camera through the 2000s couldn’t do it. He estimates that $50 million in grants and contracts went toward room-temperature radiation cameras, but no one realized the potential of cadmium zinc telluride crystals, which are at the heart of He’s camera.

“Our conclusion was that we cannot count on other companies to work on the technology,” He said. If his team wanted to see these cameras in the hands of nuclear safety professionals, they would have to start a company.

So in the fall of 2011, He began a journey that more and more faculty around the U.S. are making — from inventor to innovator. These entrepreneurs are helping universities to deliver on the promise that taxpayer-funded research will drive economic growth, and lately, universities are doing much more to help them succeed.

Universities weren’t always going on about innovation, and professors weren’t always ready to bring their own ideas to market. Until recently, academics typically took a dim view of business.

“In the old days, faculty members didn’t want to do a startup because they would be looked upon as someone who had gone over to the dark side,” said Fred Reinhart, a senior advisor for technology transfer at the University of Massachusetts Amherst and former president of the Association of University Technology Managers (AUTM, pronounced “autumn”).

But there was another factor as well — faculty inventors and universities didn’t always have the rights to their own inventions. The government bodies that provided funding for research typically retained the rights to the results. That didn’t work out particularly well: Only about 5 percent of government-patented research discoveries were successfully licensed to companies to develop into products. So in 1980, Congress passed the Bayh-Dole Act, which gave inventors, universities and laboratories intellectual property rights.

In the old days, faculty members didn’t want to do a startup because they would be looked upon as someone who had gone over to the dark side.

Fred Reinhart

That kicked off the academic foray into commercializing research findings. It started with tech transfer offices, which popped up at most major research universities across the U.S. within a few years. Reinhart joined the U-M office in 1985 as a newly minted Wolverine MBA. When he started out, it was just him, a licensing professional and two lawyers. “We were like pioneers. We were making our own road,” said Reinhart.

The first 20 years were mostly about licensing: patent the idea, give it to an existing company to develop and market, and then collect the royalties.

This route didn’t take the faculty away from their research and teaching duties. But it also left many technologies to languish in what tech transfer professionals call the “valley of death,” which lies between the exciting lab-scale results and a working prototype. Licensing based on lab results requires great faith in the invention and confidence in the company’s own ability to make it work. The distance to the finish line — and the obstacles in the way — are uncertain.

When He initially patented the underlying technology for his radiation camera in 1998, the tech transfer office couldn’t make a match for it. It was in the valley.

But professors and their recent graduates and post-docs often have the confidence and skill necessary to make it through the valley of death. It’s their discovery and they have clear ideas about its potential and limitations, so the technological challenges don’t look so scary.

In the late 1990s and early 2000s, He wasn’t quite ready to take that gamble. There was more he could do in his lab. But in 2011, he and his graduate students realized it was time.

“The original purpose of setting up the company was to keep the team together,” said He. “They were extraordinary graduate students.”

Unlike the labs and companies that had tried before, He had a team that understood every component of the detectors, and they were all about to graduate. If he couldn’t hire them, they would scatter to various companies.

Fortunately for He and his students, U-M had a solid infrastructure for faculty startups. In 2009, with strong support from Stephen Forrest, then the vice president for research, the University launched the Michigan Venture Center.

The Venture Center helps faculty inventors draw up business plans, assess the potential of their technologies, and connect with investors. It also helps faculty acquire “gap funding” to bridge the end of eligibility for academic grants and the beginning of interest from private investors. Seasoned entrepreneurs serve yearlong rotations as “mentors-in-residence” to advise on all these steps.

“We didn’t have any of that when we were getting started in the early 2000s,” said Rob Malan, one of the founders of Arbor Networks (see “Pathfinding” below). He has since served as a mentor for other U-M startup teams and is currently working on another new Ann Arbor business called Deepfield.

Through the Venture Center, He and his students learned about a business plan competition called Accelerate Michigan. They won the Defense and Homeland Security category, giving them $25,000 to get started. Michigan Engineering also kicked in close to $20,000 for parts.

“The first prototype was built during evenings and weekends,” said He.

H3D secured its first government contract to build a prototype and then four military-grade radiation cameras in 2012. These large cameras were roughly the size of a carry-on suitcase, and building them kept the company going through August of 2013. In January of that year, they won a bid for a $2.7 million contract with the Department of Defense (DoD) to build a smaller handheld version. Things seemed to be coming together.

While U-M has great support for startup companies now, things were different in 2000 when Farnam Jahanian, then the Edward S. Davidson Collegiate Professor of Electrical Engineering and Computer Science, and Rob Malan (MSE CSE ’96, PhD ’00), a research scientist at the time, founded Arbor Networks.

Malan started out with Jahanian monitoring Internet traffic through the network node at Michigan — how much data was flowing, where it came from, and where it was headed. “When you find things that don’t make sense, a lot of times it turns out to be bad guys,” said Malan.

Cyberattacks were just becoming a reality of the web in the late 1990s, so by 2000, there was a market for solutions that could shut them down. Jahanian and Malan discovered patterns in the traffic that indicated an attack. Then they developed software that could automatically detect these patterns and block the unfriendly traffic, allowing real users uninterrupted access to the website.

The inventors had help from the tech transfer office to secure patents and agree on how much of the company the University would own. But when it came to initial funding, they were on their own.

Jahanian and Malan already had research connections with HP, Cisco and Intel, and these colleagues introduced them to the venture capital arms of the companies. The computer giants offered money but no governance — they needed to find a lead venture capitalist to take them on.

Lead venture capitalists serve on the startup’s board, in addition to funding the company. Malan learned getting in touch with venture capital firms was as simple as picking up the phone. Ultimately, he and Jahanian found a match in Boston-based Battery Ventures.

The partner that he and Jahanian met, Todd Dagres, had experience building and running Internet infrastructure companies. “It’s not that you want them to give money and get out of the way,” said Malan. “VCs who have been executives are very valuable because they have scars and understanding that come only from experience.”

With the backing and oversight of Battery Ventures, Arbor Networks was in business. The next hurdle was a round of hiring. Malan remembers walking into an interview for the vice president of sales, wondering “What does a vice president of sales do?” But he and Jahanian learned quickly with the help of the recruiter at Battery Ventures.

Looking back on the effort, Malan estimates that the foundational ideas only represented about 2 percent of the work needed to get Arbor Networks off the ground. “We had no idea what we were in for,” he said.

“I never started out to be a businessman. I love doing research,” he added. “But it’s so fantastic to be able to listen to someone and solve their problem.”

Every startup faces “mortal threats” said Forrest, the Peter A. Franken Distinguished University Professor of Engineering and the Paul G. Goebel Professor of Engineering in Electrical Engineering and Computer Science (see “Before their time” below). He quoted Sherwin Seligsohn, mentor and angel investor to Forrest’s third startup: “He said, in his New Jersey accent, ‘Steve, you have to slay dragons.’”

Investors back out, new competing technology comes along, an important hire doesn’t work out, or a difficult puzzle arises in the design or manufacturing. But some dragons are more fearsome than others. For H3D, the big one was that $2.7 million contract — when it fell through.

In the spring of 2013, the DoD performed audits: one technical, which they aced, and the other financial, which they flunked. Startups don’t have much money in the bank. The DoD decided not to offer the contract in May. The team knew that they would be out of cash in September.

Every day with a small company, there is a threat. And that threat is a mortal threat.

Many startups would have the option of venture capital at or before this point, but H3D was too niche. At the time, venture capitalists imagined a market for just 350 or so of these cameras — one for every nuclear power plant in the world, maybe, but no more.

To survive, H3D needed a commercial product fast. So He and his five most recent PhD graduates buckled down and made one. They worked long hours, and the founders went without pay for up to 3 months. If they couldn’t afford to, He paid them from his own savings.

But the team was confident that the sacrifice was temporary — aware that H3D had no funding, the DoD was setting the company up with a contract that the military considered a safer investment. Still, that money wouldn’t come in until September 2014 — a year after H3D had finished its previous contract.

So He’s team focused on the task at hand: launching a product. As early as December 2012, H3D had a beta version of the hand-held Polaris-H radiation camera, which displayed its augmented-reality image of the radiation in the room on a Nexus tablet.

Weiyi Wang (MSE NERS ’08, PhD ’11) referred to the early prototypes as “Willy Kaye hack boxes,” named for the company’s president at the time. Kaye (MSE NERS ’08, PhD ’12), who took over from He as CEO in 2014, housed the crystal and electronics in off-the-shelf Pelican cases, modified by hand-drilling and mounting parts inside and out.

H3D received feedback from two early adopters through 2013. In December, they took a polished product in a sleek aluminum case on the road to nuclear power plants that had expressed interest. They had four orders by the end of the month. Then, they had to build the cameras. “We pretty much worked through the holiday,” said Wang, now an engineer and the sales director at H3D.

Demanding hours are par for the course in the startup world, but He didn’t take his team’s dedication for granted. “It was amazing to me that the team was so determined,” said He.

They were all personally invested in making the new technology succeed, and they also didn’t want to let one another down. They kept H3D afloat until the next government contract came in. The next December, the team found themselves working through another holiday rush — but this time, H3D had money to spare for bonuses.

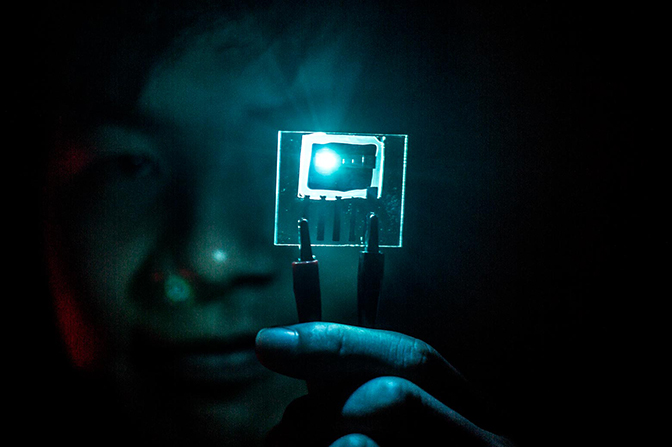

When Stephen Forrest partnered with Mark Thompson while working at Princeton in 1993, their work rapidly advanced the nascent technology of organic light emitting diodes, or OLEDs. Thompson was already in contact with investor Sherwin Seligsohn, who immediately took a shine to their OLED work.

“It’s a new kind of light!” Forrest remembers Seligsohn saying.

It was very early days for OLEDs — they had efficiency problems, reliability problems, and they couldn’t yet cover the whole range of colors needed for a high quality display. But if they could work, it would be possible to make a display that didn’t need a backlight. The screen would have better contrast and require less power. It wouldn’t even have to be flat.

Seligsohn was a believer, and Forrest and Thompson were confident that they could overcome the challenges by tinkering with the chemical makeup of the light-emitters. They founded Universal Display Corporation in 1994 to continue working out the kinks as the problems advanced beyond academic research and entered product development.

Seligsohn mentored Forrest and Thompson and warned them about the road ahead, delivering his line about slaying dragons.

“And what he meant by that was every day with a small company, there is a threat. And that threat is a mortal threat,” said Forrest. “You need to know how to deal with it to get on to the next mortal threat.”

They needed a CEO, more investors and staff. They had to watch out for other technologies that might take over their market. And they had to perfect the efficiency, color, brightness and reliability of their OLEDs. But the biggest problem they had was that it was too soon for the technology.

“I went to Japan because that was the only place that was even thinking about making displays out of OLEDs,” said Forrest. “I think I went to Japan 50 times.”

Nothing ever came of it. Still, the team stayed optimistic and kept meeting with potential customers.

Finally, in the early 2000s, Samsung in Korea licensed Universal Display Corporation’s technology for what would become its flagship smartphone. The Galaxy S, released in 2010, sported the first commercial display underpinned by Forrest and Thompson’s discoveries.

Profits didn’t come in until 2012. But after that, the success was astronomical. Samsung and LG branched out to fully OLED TVs, some curved to take advantage of the display’s flexibility. Universal Display Corporation has reported more than $100 million in profits each year for the past three years.

Access to information has helped smooth the startup process considerably, but one weak spot for many universities is access to investors. Startups are generally risky investments, and some research-inspired technologies, like He’s, are so new that the market is difficult to assess.

But the numbers suggest that U-M startups are actually good bets. While the proportion of startups that live for four years or more hovers around 50 percent, U-M startups beat these odds with a survival rate above 80 percent, said Mark Maynard, marketing manager in the U-M Tech Transfer office.

The venture capital firm Osage ran the numbers on 20 years of U-M faculty startups and found that if U-M had invested equally in all of them, the return would be “very attractive,” according to a Marc Singer, a managing partner at Osage. So starting in 2011, U-M began to use its own endowment money to back faculty startups that already had investment commitments from venture capital firms.

The numbers suggest that U-M startups are actually good bets.

This is a smart move, according to Walter Valdivia, a research fellow at the Brookings Institute in Washington, DC. His analysis showed that licensing patents doesn’t pay the bills at most tech transfer offices — for 85 percent of universities, they are a net loss to the university’s general fund. This is partly because two thirds of the income typically goes straight to the inventors and the associated lab or department.

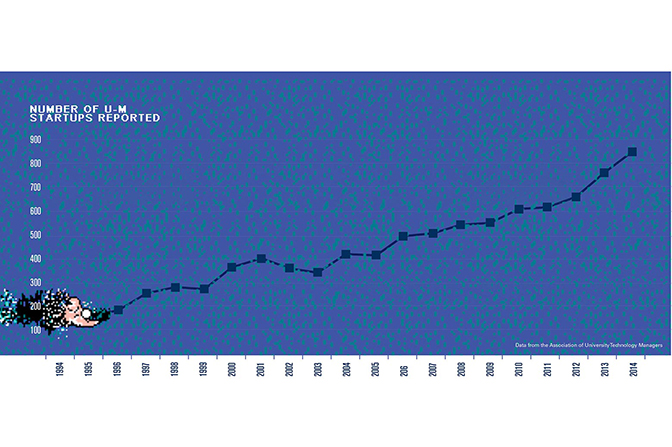

But startups could change the game if universities invest in them. The value of an invention grows rapidly as a startup hammers out solutions to its potential problems, and U-M is not the only university that can benefit by backing its own technologies early. University startups are a national trend — the number of new startups reported to AUTM has more than quadrupled since 1994. In that year, U-M had zero. Last year, it had 19.

States play roles in helping research-inspired businesses get off the ground as well. Gap funding for U-M startups often comes from the state through bodies such as the Michigan Economic Development Corporation (MEDC). One recent recipient of funding from the MEDC is the battery startup Elegus Technologies (see “Reinventing the invention” above). And Michigan isn’t alone: many other state governments are investing in small businesses, particularly in the Midwest.

All told, the developments are beginning to create the economic impact that the signers of the Bayh-Dole Act hoped for. Over the last 16 years, the technology transfer office at U-M boasts more than 2,000 jobs created, many of them in the state. And as of the end of 2014, over 4,400 businesses existed because they spun out of universities nationwide, including 137 from U-M.

Sometimes, the initial idea for an invention and what the market wants from it are two different things. Around five years ago, Nicholas Kotov, the Joseph B. Florence V. Cejka Professor of Chemical Engineering, and student Siuon Tung wondered whether a divider made from recycled Kevlar could prevent fire-starting shorts in lithium-ion batteries. They ran an experiment, and the results were enough to justify a patent on the concept.

However, it wasn’t the kind of patent that would license itself. So, when the Center for Entrepreneurship (CFE) invited Kotov to propose a case study to Master of Entrepreneurship students in the fall of 2013, he brought them the Kevlar battery divider.

As he presented the technology, Kotov noticed a tall young man with big hair watching intently. This fellow, John Hennessy, saw potential.

“The technology was advanced enough that we could take it somewhere, and there was a huge upside for batteries and electric vehicles if it could be realized,” said Hennessy, now the CEO of the startup, Elegus Technologies.

With two other entrepreneurship students, Kotov, Tung and Hennessy developed the concept for the product — a divider between electrodes in lithium-ion batteries that would be much safer than the standard divider, without adding bulk. But in spite of the recent Boeing 787 fires, improving safety did not interest the battery industry.

To find out what industry did want, the Elegus team spent the fall of 2014 in the National Science Foundation’s Innovation Corps (I-Corps) program, an entrepreneurship boot camp for faculty startups. I-Corps, started in 2011, is an effort to support research-inspired entrepreneurship at a national level. Companies that go through it are on the short list for federal grants aimed at tech startups.

“It’s a grueling process,” said Kotov. “During the program, the coaches and instructors kick your soft spots very intensely.”

After 100 interviews with representatives of companies that might have an interest in the new dividers, the Elegus team understood that battery customers demanded more capacity — safety levels are considered adequate. And the new separator could meet this demand because it can be thinner than current dividers without sacrificing safety, leaving more room for electrode materials.

Elegus also needed to develop the idea to the point that industrial partners could see a path to using the new dividers into their existing manufacturing process.

“The current structure of large-scale industry, especially in the battery field, does not allow integration of new materials,” said Kotov.

They did that work with help from the Michigan Translational Research & Commercialization program, run through the CFE and the U-M Tech Transfer office. After rounds of vetting that Kotov compares to the heavy scrutiny from I-Corps, Elegus received $175,000, funded in part by the State of Michigan.

Having solved many of the technological challenges posed by using a thinner divider in a battery, Elegus has now teamed up with XALT Energy, which Hennessy says is one of the largest lithium ion battery manufacturers in the U.S. Last summer, the two companies launched a joint venture in which Elegus will offer its patented ideas and XALT will provide funding to explore how to manufacture batteries with the new dividers.

“It’s full speed ahead,” said Kotov.

Funding challenges aside, the success of a startup comes down to one question: Is this a product that someone wants?

Fortunately for H3D, the prospective investors were wrong about the potential market for a room-temperature radiation camera. Some nuclear power plants now have four of the new handheld cameras, which are significantly cheaper and easier to use than the old industry standard: 40-pound cryogenic radiation detectors. H3D is preparing to launch a new commercial camera based on the cancelled grant, a handheld design with better identification of radiation sources.

With greater support for faculty startups at universities across the U.S., more research-inspired technologies will make it into the hands of potential customers. And if U-M’s experience is anything to go by, the universities will measure their impact not just in degrees and research articles but also in new local jobs.